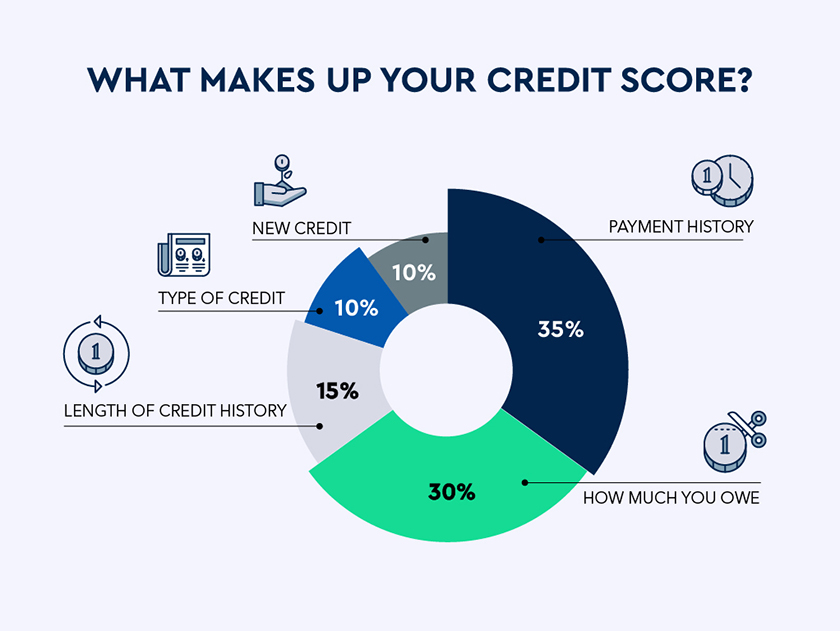

While making money on time is very important, and how much of your offered borrowing you use is yet another foundation

If you are intending to find property, however your credit score is lower than simply in which you would love that it is, discover activities to do to evolve the situation. Trying to get this new finance will reduce your credit rating temporarily, and there was mistakes in your credit report. Taking the time to manage these problems makes it easier to get approved towards the mortgage you would like.

Your own month-to-month bills as compared to your earnings usually cannot be higher than simply 43% if new house financing money are included. This might be known as the rear-prevent DTI proportion, even in the event in some situations, the lender may agree which have higher a beneficial DTI.

There is also a front-end DTI ratio that is the disgusting month-to-month income while the client’s most recent obligations payments. Lenders dislike observe which DTI proportion more than 31% usually.

Particularly, when you have a blended gross income away from $eight,000 a month, in debt costs regarding $dos,000, brand new computation might be dos,000 / seven,000 = 0.2857. This means a top-prevent DTI proportion out of just below twenty eight.6%.

Your bank usually look at your personal debt-to-income ratio when considering the loan application

If possible mortgage costs rates $1,000 a month, this can be put into the money you owe to get the back-prevent DTI proportion. So utilizing the same example, the newest calculation could be step 3,000 / seven,000 = 0.4286. This gives an in the past-end DTI away from 42.9% and simply less than what is actually constantly enjoy of the lenders.

The lending company must be certain of the latest client’s money and possessions, so that they need recorded proof. This might mean new borrower should offer shell out stubs having at the least 60 days, and you may W-dos versions over the past a couple of years would be adequate. While notice-functioning, the financial institution will need the tax statements, both personal and you may organization, for the early in the day one or two calendar decades.

Getting buyers which might be making use of their very own currency to cover brand new deposit and you can closing costs, proof of this type of financing must be provided. This will only be comments out-of coupons, examining, and other particular membership. In the event the money is used away from investment, an announcement of a good investment agent saying the worth of assets could be needed.

When you’re taking assistance from relatives or relatives to fund their down-payment, this needs to be documented as well. For individuals who located a gift to increase your down payment, it ought to be accompanied by a down-payment provide page. This will are the address of the house, extent https://paydayloanalabama.com/clio/ given, state the relationship towards the homebuyer, and then make it obvious that it is a gift that does not have to be repaid.

In the event that a cashier’s see was used to offer the current, there must be a duplicate for the take a look at offered to the latest financial too. The same is probably needed in case your cash is skilled out of financial support levels whenever brings or ties can be purchased.

Should your money is from the family savings of one’s gifter, they must offer a copy of one’s declaration before and you can after the money has been taken

After you accept a gift, you also need to make sure you file the income entering your bank account therefore, the bank are able to see this new balance pre and post the money is extra. By taking this type of methods, you should get the underwriting techniques are a little convenient and less.

When the lender approves a keen FHA mortgage, there can be a necessity to spend mortgage insurance. This covers the lending company if the poor happens and also the borrower struggles to pay the loan. Whilst bank can begin property foreclosure process to recoup the a fantastic financial obligation, home loan insurance coverage protect them against a loss.

Deja una respuesta

Lo siento, debes estar conectado para publicar un comentario.